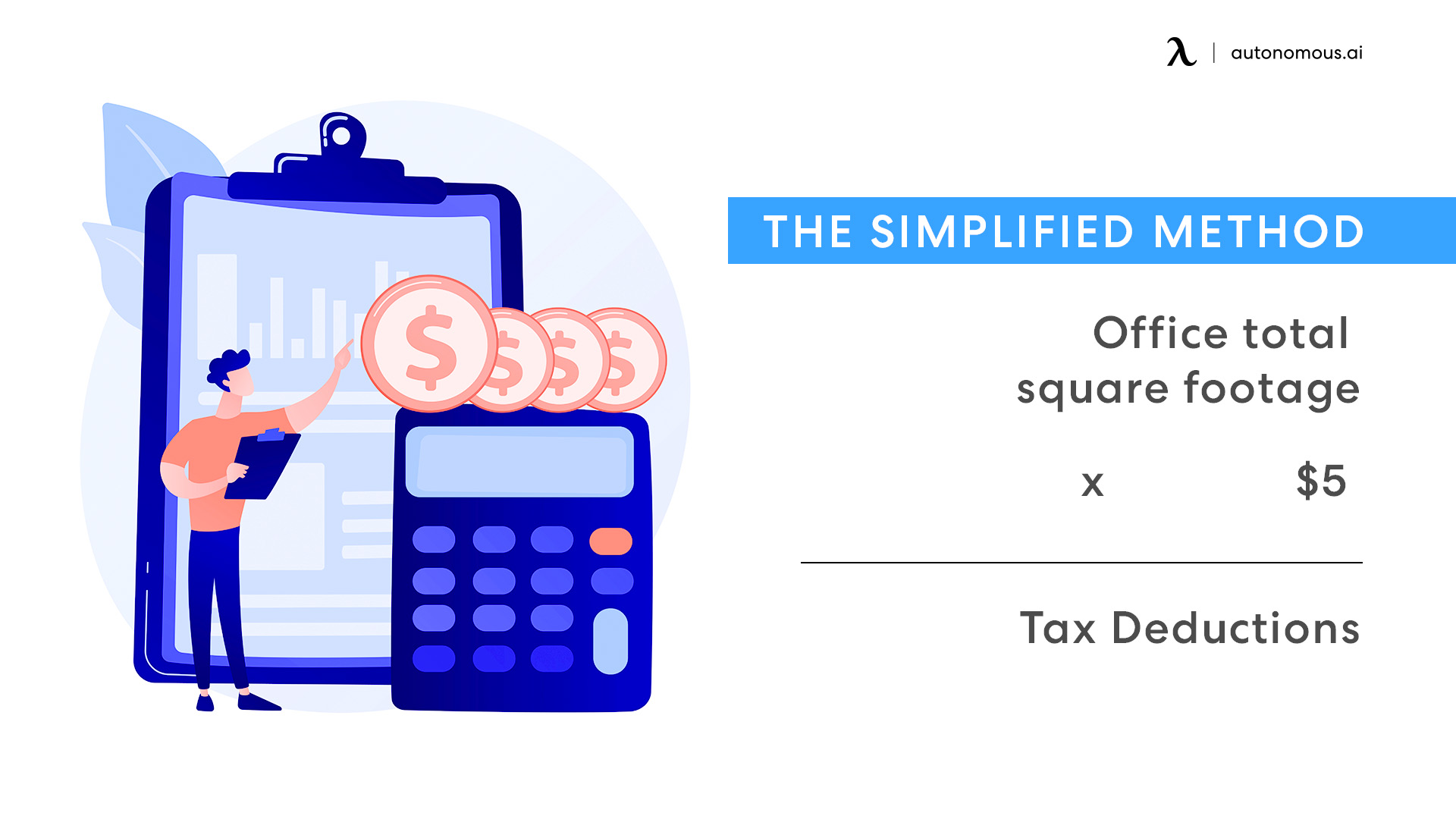

How To Get The Home Office Deduction . You can take the simplified or the standard option for calculating. the home office deduction, calculated on form 8829, is available to both homeowners and renters. home office deduction at a glance. If you use part of your home exclusively and regularly for conducting. Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation. to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. how do i calculate the home office tax deduction? to qualify for the home office deduction, you must meet one of the following criteria from the irs:

from www.autonomous.ai

You can take the simplified or the standard option for calculating. how do i calculate the home office tax deduction? the home office deduction, calculated on form 8829, is available to both homeowners and renters. home office deduction at a glance. to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. to qualify for the home office deduction, you must meet one of the following criteria from the irs: If you use part of your home exclusively and regularly for conducting. Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation.

Home Office Deduction During Covid 2024 Update

How To Get The Home Office Deduction home office deduction at a glance. Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation. home office deduction at a glance. the home office deduction, calculated on form 8829, is available to both homeowners and renters. how do i calculate the home office tax deduction? to qualify for the home office deduction, you must meet one of the following criteria from the irs: You can take the simplified or the standard option for calculating. to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. If you use part of your home exclusively and regularly for conducting.

From www.youtube.com

How to Calculate Your Home Office Deduction YouTube How To Get The Home Office Deduction home office deduction at a glance. the home office deduction, calculated on form 8829, is available to both homeowners and renters. to qualify for the home office deduction, you must meet one of the following criteria from the irs: to qualify for the home office deduction, you must use part of your home regularly and exclusively. How To Get The Home Office Deduction.

From www.ramseysolutions.com

Working From Home? Home Office Tax Deduction Ramsey How To Get The Home Office Deduction If you use part of your home exclusively and regularly for conducting. Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation. home office deduction at a glance. to qualify for the home office deduction, you must meet one of the following criteria from. How To Get The Home Office Deduction.

From tax-queen.com

6 Simple Steps to Take the Home Office Deduction How To Get The Home Office Deduction to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. how do i calculate the home office tax deduction? to qualify for the home office deduction, you must meet one of the following criteria from the irs: Your home office business deductions are based on either the percentage. How To Get The Home Office Deduction.

From www.stkittsvilla.com

Is Taking A Home Office Deduction Smart American Portfolio Blog How To Get The Home Office Deduction how do i calculate the home office tax deduction? home office deduction at a glance. the home office deduction, calculated on form 8829, is available to both homeowners and renters. You can take the simplified or the standard option for calculating. If you use part of your home exclusively and regularly for conducting. to qualify for. How To Get The Home Office Deduction.

From turbotax.intuit.com

The Home Office Deduction TurboTax Tax Tips & Videos How To Get The Home Office Deduction the home office deduction, calculated on form 8829, is available to both homeowners and renters. how do i calculate the home office tax deduction? home office deduction at a glance. to qualify for the home office deduction, you must meet one of the following criteria from the irs: You can take the simplified or the standard. How To Get The Home Office Deduction.

From www.abovethecanopy.us

The Home Office Deduction Simplified Vs Actual Expense Method How To Get The Home Office Deduction to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. the home office deduction, calculated on form 8829, is available to both homeowners and renters. Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation.. How To Get The Home Office Deduction.

From www.taxdefensenetwork.com

An Easy Guide to The Home Office Deduction How To Get The Home Office Deduction to qualify for the home office deduction, you must meet one of the following criteria from the irs: the home office deduction, calculated on form 8829, is available to both homeowners and renters. If you use part of your home exclusively and regularly for conducting. how do i calculate the home office tax deduction? home office. How To Get The Home Office Deduction.

From www.keepwhatyouearn.com

How to Take the Home Office Deduction How To Get The Home Office Deduction to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. If you use part of your home exclusively and regularly for conducting. to qualify for the home office deduction, you must meet one of the following criteria from the irs: the home office deduction, calculated on form 8829,. How To Get The Home Office Deduction.

From www.kitces.com

Home Office Deduction Rules When Working From Home How To Get The Home Office Deduction to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation. how do i calculate the home office tax deduction? If you use part of your. How To Get The Home Office Deduction.

From www.patriotsoftware.com

Home Office Tax Deduction Deduction for Working from Home How To Get The Home Office Deduction You can take the simplified or the standard option for calculating. home office deduction at a glance. Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation. to qualify for the home office deduction, you must meet one of the following criteria from the. How To Get The Home Office Deduction.

From amnestymedia.org

The Complete Guide to Home Office Deduction & How to Make the Most of How To Get The Home Office Deduction You can take the simplified or the standard option for calculating. Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation. how do i calculate the home office tax deduction? to qualify for the home office deduction, you must use part of your home. How To Get The Home Office Deduction.

From www.exceptionaltaxservices.com

Save Big Time On Taxes How To Do Your Home Office Deduction Right How To Get The Home Office Deduction to qualify for the home office deduction, you must meet one of the following criteria from the irs: If you use part of your home exclusively and regularly for conducting. how do i calculate the home office tax deduction? the home office deduction, calculated on form 8829, is available to both homeowners and renters. home office. How To Get The Home Office Deduction.

From alloysilverstein.com

Making Your Home Office a Tax Deduction Alloy Silverstein How To Get The Home Office Deduction You can take the simplified or the standard option for calculating. home office deduction at a glance. the home office deduction, calculated on form 8829, is available to both homeowners and renters. If you use part of your home exclusively and regularly for conducting. to qualify for the home office deduction, you must use part of your. How To Get The Home Office Deduction.

From www.iota-finance.com

Saving on taxes using the home office deduction How To Get The Home Office Deduction to qualify for the home office deduction, you must use part of your home regularly and exclusively for business. You can take the simplified or the standard option for calculating. how do i calculate the home office tax deduction? Your home office business deductions are based on either the percentage of your home used for the business or. How To Get The Home Office Deduction.

From lyfeaccounting.com

Home Office Deduction Explained Write Off & Save on Taxes How To Get The Home Office Deduction Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation. the home office deduction, calculated on form 8829, is available to both homeowners and renters. to qualify for the home office deduction, you must meet one of the following criteria from the irs: You. How To Get The Home Office Deduction.

From www.smallbusinesssarah.com

How to Get a Home Office Tax Deduction Small Business Sarah How To Get The Home Office Deduction You can take the simplified or the standard option for calculating. how do i calculate the home office tax deduction? to qualify for the home office deduction, you must meet one of the following criteria from the irs: the home office deduction, calculated on form 8829, is available to both homeowners and renters. If you use part. How To Get The Home Office Deduction.

From exceldatapro.com

Home Office Deduction Definition, Eligibility & Limits ExcelDataPro How To Get The Home Office Deduction You can take the simplified or the standard option for calculating. the home office deduction, calculated on form 8829, is available to both homeowners and renters. Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation. to qualify for the home office deduction, you. How To Get The Home Office Deduction.

From www.autonomous.ai

Home Office Deduction During Covid 2024 Update How To Get The Home Office Deduction the home office deduction, calculated on form 8829, is available to both homeowners and renters. You can take the simplified or the standard option for calculating. home office deduction at a glance. to qualify for the home office deduction, you must meet one of the following criteria from the irs: to qualify for the home office. How To Get The Home Office Deduction.